What do Apple, Best Buy, NetSuite and Sears all have in common?

They all sell multi-element products, whether it's a refrigerator sold with a maintenance contract, a smart-phone sold with "more than incidental software," or, as in NetSuite's case, subscription software that's sold together with support and services.

In the past, companies could try to allocate the value of each item and recognise them separately, but if they couldn't meet strict valuation requirements, they would have to account for the whole sale as a single unit of accounting and recognise all of the revenue together. Under the freshly minted set of Financial Accounting Standards Board (FASB) rules, that's no longer an option.

Anyone who sells products or services that are delivered at different times could be affected by these rules. This is the most widespread change to revenue recognition rules in recent years and will impact many companies across a broad range of industries. The new rules come into effect for fiscal years beginning on or after June 15, 2010, but early adoption is possible.

Many companies have been eagerly awaiting this rule change because they feel it more closely aligns their revenues with their costs. Apple, for example, has been at the forefront in pushing for these changes. Under the old rules, Apple had to recognise all iPhone revenue over a two-year period. These new revenue recognition changes now enable Apple to recognise the iPhone hardware revenue as soon as it is sold, while the revenue recognition for the software is based on an estimated value that is spread over the life of the iPhone. Apple early adopted in the first quarter of fiscal 2010 and the impact to their results was substantial. In fact, the adoption of the new accounting principles increased Apple's net sales by $6.4 billion, $5.0 billion and $572 million for 2009, 2008 and 2007, respectively.

My own company NetSuite, has evaluated these new accounting rules and has announced we will be early adopting in 2010. These rules have a cross-departmental business process impact, and they require close scrutiny of controls and the implementation of new processes. With the introduction of these new rules, having the right business systems in place makes all the difference in speed of adoption and ongoing management.

In this letter, I'll explore the latest FASB rules that were finalised in October—EITF 08-01 (FASB rule ASU 2009-13) and EITF 09-03 (FASB rule ASU 2009-14)—and identify some of the key considerations that you should apply to your business.

First, Some Background

Let's take a moment to explore some of the history and drivers behind the new FASB rules. The

new rule EITF 08-01 now supersedes EITF 00-21, which previously set forth the requirements that

must be met for a company to recognise revenue from the sale of a delivered item that is a part

of a multiple-element arrangement when other items have not yet been delivered.

Under EITF 00-21, companies had to provide objective and reliable evidence of the fair value of each item sold under a single contract in order to separate them. When fair value wasn't available, the result was often deferral of the revenue until all items had been delivered, or recognition of the revenue over the term of a contract—even if some of the elements, such as services, might have been fully delivered early on. This resulted in a substantial impact (i.e., delay) on how a company reported its revenue, and in many cases, a significant mismatch between revenues and costs.

Understanding the New Rules

So, what are the two new rules, in a nutshell?

- EITF 08-01 (ASU 2009-13): Relates to revenue arrangements with multiple deliverables.

- EITF 09-03 (ASU 2009-14): Deals with arrangements that include both hardware and software elements.

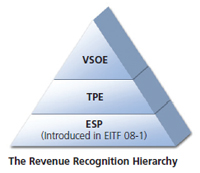

Broadly speaking, the impact of EITF 08-01 is that companies that had been required to recognise multiple elements under a single unit of accounting must break those out into multiple units, and recognise them at different rates—meaning they can recognise revenue more quickly on some elements than they could before. The new guidance in EITF 08-01 introduces a third tier of evidence that you are required to follow to separate out different elements of a contract. If Vendor Specific Objective Evidence (VSOE) is available, that must be used. If not, Third Party Evidence (TPE) must be used, and if neither is available, then a new concept called Estimated Selling Price (ESP) is used.

For those of you familiar with software revenue recognition rules, VSOE has no doubt been the source of many sleepless nights and long conversations with your auditors. Given the difficulty in proving VSOE or the frequent lack of availability of TPE, I would expect that ESP will be the most frequently used method and the subject of many new long, enjoyable and expensive conversations.

Once you have established a standalone selling price for each item, you then have to allocate the total contract price to each line item based on its "relative selling price." That means the price you sell something for and the amount you recognise as revenue will usually be different.

So, in short, the value of each component is determined independently (VSOE if available, TPE if no VSOE, and ESP if no TPE), and the value of a customer's order (or sales order) is divided pro-rata based on those values.

Each element is then recognised according to the revenue recognition rules applicable for that type of item. It's worth noting that the introduction of these rules means the elimination of the residual method (and if you don't know what that is, consider yourself fortunate).The Keys to Getting Your Financial Processes in Shape

The impact of the new rule for a Software-as-a-Service (SaaS) company like NetSuite is the

ability, even in the absence of fair value, to recognise delivered elements such as services

early on in the contract when they are delivered, rather than having to recognise all the

elements over the contract term.

However, underlying financial and operational systems and processes must be evaluated and changed to ensure they meet the new rules. Key best practices for ensuring that your business is in good shape to adopt this new favorable revenue recognition rule include:

- Centralise the data that's required to calculate Estimated Selling Price

(ESP). A single repository of sales, finance and services data is extremely

valuable when calculating ESPs. Without it, calculating them can become a time-consuming

manual process. Moreover, it can be risky to rely on spreadsheets to reconcile relevant data

from across multiple line of business systems, especially given constantly changing market

conditions.

For example, the average sales price for services may be derived from hourly billing rates that may vary based on geography or type of resource. Product sales prices may vary based on discount rates, partner channels, or industry. For multinational businesses, yet another challenge is the added complexity of ensuring that currency rates are correctly applied to ESPs.

A recent publication by KPMG1 outlined a structured methodology for calculating ESPs that provides a sense of the value of having data centralised, for both calculation and continual monitoring:- Step 1: Gather all reasonably available data points.

- Step 2: Consider adjustments based on market conditions (e.g., demand, competition, trends and constraints) and entity-specific factors (e.g., pricing strategies and practices, market share and position).

- Step 3: Consider the need to stratify selling prices into meaningful groups based on customer type, deal size or customer volume, geography, distribution channel or other relevant groups.

- Step 4: Weight available information and make a best estimate.

- Step 5: Establish processes for ongoing monitoring and evaluation.

- Ensure strong integration between professional services automation (PSA) systems and financials. Given that companies can now recognise services delivery on a different schedule than subscription revenues, it becomes critical to ensure that the PSA system is tightly integrated with the financials. Non-integrated PSA systems or spreadsheets can easily result in confusion around what part of the project has been delivered and its impact on revenue recognition. If you have strong integration between services and finance systems, with services delivery based on project-based milestones or other delivery checkpoints, you can transfer the revenue automatically and reliably into your financial system for recognition.

- Scrutinise and align your financial system and existing revenue recognition processes to cope. A significant number of prospective customers we speak to are already doing their revenue recognition calculations outside of their financial systems—often on spreadsheets—because they have reached the limits of their existing accounting systems. For them, revenue recognition is already an error-prone process. However, the advent of this rule obviously adds a new dimension of complexity, given the need for up-todate ESPs, automated pro-rata calculations and multiple revenue recognition schedules. So it's important to take a look at your existing accounting systems and processes, and understand if there is going to be a substantial impact in terms of additional time-consuming processes or increased risk of ongoing of manual errors.

- Align your sales quotes with your financials. These rules will not only impact your ability to prepare financials after the sale is done but they will also significantly impact your ability to forecast what your revenue will be. You need to ensure that your systems and processes provide you with the flexibility to manage the sales amount that is presented to your customer (i.e., the sales price on the quote or invoice), while also being able to subsequently allocate the amount in order to create the value that will be recognised. The relevant allocations and calculations must be managed correctly—and preferably, automatically.

- Ensure you're positioned to manage and recognise all types of revenue. It's critical to take a comprehensive look at the various types of revenue—such as time-based, percentage of completion (for services), event-based, etc.—and ensure that your existing financial processes and systems are ready to handle these multiple elements.

-

Adopt ongoing visibility into summary and detailed recognised revenue as the rules take effect. Once you begin to adopt these new revenue recognition rules, you'll want to continually monitor the effect on your financial reporting and ensure that you're recognising revenue as you expected to. Relying on spreadsheets or trying to reconcile information across multiple systems will be even less adequate.

Ideally, real-time dashboard visibility should enable you to continually monitor recognised revenue; examine breakouts of recognised revenue across the various elements; provide detailed visibility down to the transaction level; help ensure that you're confident in reporting your financials; enable you to keep ongoing tabs on the accuracy of the ESPs; and ensure that you're able to quickly diagnose any unforeseen issues that arise. In addition, it's important to ensure that you are equipped to handle the more complex revenue and deferred revenue reporting (by region, product line, etc.) resulting from the new rules.

At NetSuite, we run our business on NetSuite—which means our business systems must already be closely aligned to enable us to quickly take advantage of these new rules. We have made it a priority to ensure that the NetSuite system can already support these recent changes to revenue recognition rules (i.e., EITF 08-01, and EITF 09-03) and can otherwise support all relevant revenue recognition requirements for software companies and broader industries (i.e. SOP 97-2, SOP 98-9, EITF 00-21)

It leaves us in a strong position to ensure that our financial and operational systems aren't a roadblock to adopting this preferred revenue recognition method, and that we can focus on booking the revenue, rather than spending time and resources managing the underlying systems.

NetSuite also offers its revenue recognition functionality as a standalone cloud based application specifically designed just to handle revenue recognition for companies that might just need this incremental functionality to their existing ERP systems. We are working with many system integrators who are experts in integrating NetSuite with other ERP applications such as SAP, Oracle and Great Plains. Customers are finding this is a much quicker and controlled way to ensure that the new rules are efficiently and accurately implemented than by using manual methods. It also has the advantage that it can take data from multiple systems and produce the actual revenue recognition journals that you'll need to have your financials correct.

Best Regards,

Jim McGeever, COO, NetSuite.